What is GRN in GST: Meaning & Process

- 8 Oct 25

- 9 mins

What is GRN in GST: Meaning & Process

Key Takeaways

- A Goods Received Note (GRN) in GST is a legal document confirming receipt of goods, ensuring transparency in procurement and payment processes.

- GRN plays a vital role in inventory management by maintaining accurate stock records and preventing discrepancies in warehouse entries.

- The three-way matching process (PO, invoice, and GRN) helps validate supplier invoices and ensures secure payment under GST compliance.

- GRN serves as evidence for dispute resolution between buyers and suppliers regarding quality, quantity, or delivery issues.

- Automated GRN systems reduce manual errors, save time, and improve operational efficiency in GST-based procurement workflows.

Goods Received Note (GRN) is a crucial document issued to confirm the acceptance of goods by the buyer after delivery from the supplier. To simply put what is GRN in GST, it is an important piece of evidence for businesses, playing a key role in the payment process.

It supports current inventory management, helps maintain accurate stock records, aids in dispute resolution and facilitates the three-way matching mechanism (PO, invoice, and GRN). By adopting GRN automation, companies can significantly reduce manual tasks, minimise errors and improve operational efficiency.

Let us explore everything about GRN, from its components and importance to the complete process.

What is GRN in GST?

The Goods Received Note (GRN) is a legal document issued by the buyer upon receiving the purchased products from the supplier. The GRN serves multiple purposes, including acting as proof of receipt, facilitating the financial reconciliation of the quantity and quality of goods against the purchase order (PO) and confirming delivery.

This tool helps maintain transparency in business processes, which is why it is one of the most prevalent documents by the store's procurement department.

How is GRN Used in the Procurement Process?

The procurement procedures of any store involve multiple stages, where departments and companies use GRN to:

- Verify and confirm the quantity and quality of goods delivered

- Cross-check the delivery details against the corresponding purchase entries

- Enables businesses to keep stock levels accurate while preventing issues like running out of inventory

- Often accompanies the invoice or bill provided by the supplier

Additionally, the finance department of a large enterprise relies on the GRN to conduct a three-way matching between the GRN, the purchase order and the supplier’s invoices. It helps ensure accuracy before making payments.

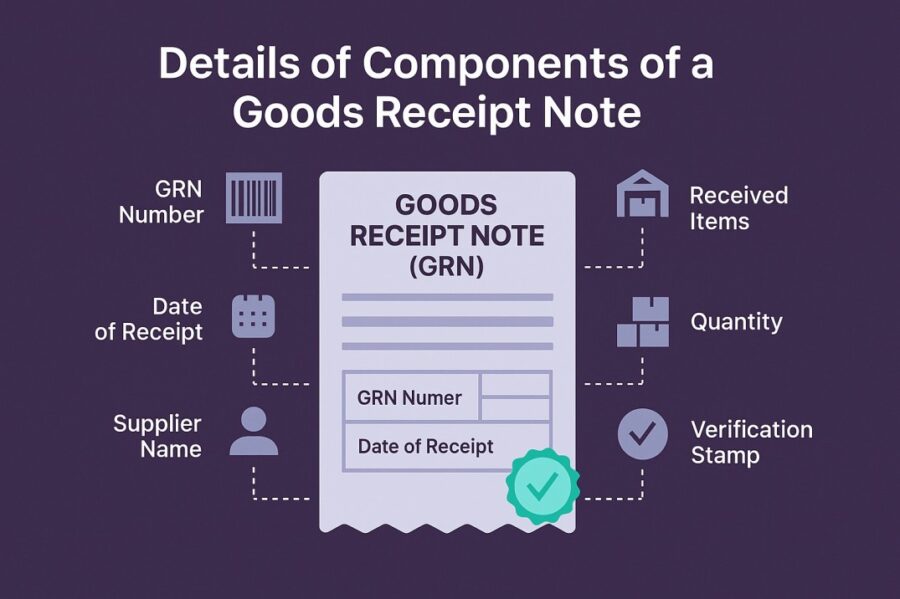

Details of Components of a Goods Receipt Note

Here is a complete breakdown of the key components of a Goods Received Note:

- The Header Part

This portion of a GRN consists of several essential details such as the company name, the receipt date and time and most importantly, the GRN number.

- Details of Supplier

This section asks you to fill in the supplier details, including their name, official address and verified contact details.

- Delivery Details

Here, the buyer enters information about the delivery itself, such as the location, mode of transportation (whether by road or air, etc.) and any special instructions.

- Product Descriptions

This section captures a comprehensive list of all items received from the supplier. It includes the serial number, a clear and concise description of each product, the correct quantity and any comments (if applicable). Additionally, it specifies the price of each item as agreed upon in the purchase order (PO).

- Total Value

The estimated total cost for all the items bought from the supplier (actual quantity multiplied by product price).

- Quality Check

Most GRNs include a section for quality checks conducted by an authorised individual. This helps prevent any discrepancies related to damage or quality upon arrival.

- Signatures

Another important section of a GRN is the 'Received By' and 'Delivered By' fields. Both the receiving and delivering parties need to sign the GRN to acknowledge the receipt and verify the delivered goods.

Significance of a Goods Received Note

The GRN plays a crucial role when it comes to ensuring seamless and accurate procurement procedures. Here is the total breakdown as to why it is important:

1. Validating Quantity and Quality Details of Goods

When the supplied goods meet the required standards, the buyer issues a Goods Received Note to the counterparties to confirm acceptance. This helps prevent any future disputes regarding the quantity or quality details of items delivered.

2. Resolving Disputes with Suppliers

As the GRN serves as official evidence, business owners can use it to resolve disputes with suppliers if any discrepancies arise between the ordered and received goods. In this context, the GRN plays a crucial role. Both buyers and suppliers can rely on it to address such issues, so it is essential to carefully review the GRN before confirming it with a signature.

3. Validating Supplier Invoices During Three-Way Match Process

3-way matching is an outstanding verification process, making it widely used as a secure payment gateway. It comprises verifying an invoice by cross-checking it against three essential documents.

- Purchase Order (PO)

This crucial document, developed between a supplier and a buyer, outlines the agreed-upon purchase details, including the quantity, determined price and specifications of the goods.

- Goods Received Note (GRN)

It confirms the actual condition and quantity of the delivered items, date and time, delivery location, order number, total cost and quality check.

- Supplier’s Bill

It is an invoice with details and the said amount by the supplier for the delivered goods.

When all three documents match in terms of quantities, quality and prices, the buyer processes the payment. The 3-way matching technique helps to prevent potential human errors, find discrepancies and avoid overpayment for products or services.

4. Managing Inventory

Among other crucial documents, the GRN serves as proof that goods were supplied. It helps calculate the warehouse figures for the goods delivered to the respective buyer. In this way, Goods Received Notes assist in managing inventory levels and maintaining an accurate warehouse stock ledger.

5. Auditing and Regulatory Compliance

Having a GRN supports both internal and external audit purposes. As the note serves as evidence, the supplier can use it to prove that the goods were delivered, while the buyer can confirm that the items were received. Ultimately, this helps the company’s finance team during audit trails.

Drawbacks of a GRN or Goods Received Note

There are a few issues identified by the procurement department with GRNs. Let us explore:

- Time-taking Procedure

According to the procurement department, the process of issuing and processing GRNs is time-consuming. It takes longer than usual when goods are delivered in large quantities or at frequent intervals. These cases slow down the entire process and affect overall efficiency.

- Reliance on Purchase Order

A GRN is only valuable and reliable when that initial purchase order is accurate. Inaccuracies in the PO may be reflected in GRN copies, resulting in discrepancies during later stages of the procurement process.

- Massive Paperwork Needed

In the traditional process, buyers opt for physical copies of GRNs that are prone to human errors and can be misplaced due to mishandling. Besides, it requires manual data entry, which can also introduce mistakes.

Further, it is issued in several copies, one for the procurement department, one for the person managing accounts payable and one to the supplier. Managing these copies becomes quite a challenging task, causing delays and errors.

What is the Procedure to Issue a GRN?

The buyer needs to follow the following process to issue a GRN:

1. Receive the bill and PO for items that need to be received.

2. Supervise goods at the delivery location.

3. Perform an accurate verification process of goods delivered by the supplier to ensure that the quantity and quality are as per the standard determined in the purchase order. Also, conduct some quality tests on a few materials.

4. Inform the supplier about receiving goods.

5. Once verified, the responsible department can issue several copies of the GRN. The department must sign the notes and verify with the help of the department manager and verifier. Then the authority sends a copy to the supplier to confirm receipt of goods. Later, other copies are shared with the relevant departments.

Conclusion

Most entities consider the Goods Received Note (GRN) as concrete evidence of the receipt of goods. Thus, it is crucial to understand what is GRN in GST for business compliance. It not only aids in inventory management but also makes sure that the condition and quantity of delivered goods are verified.

In addition, it serves as a crucial record that accountants can rely on to perform their duties accurately and efficiently.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.